As we continue on into the digital age, the rise of cryptocurrencies like Bitcoin (BTC) continues to reshape our economic world.

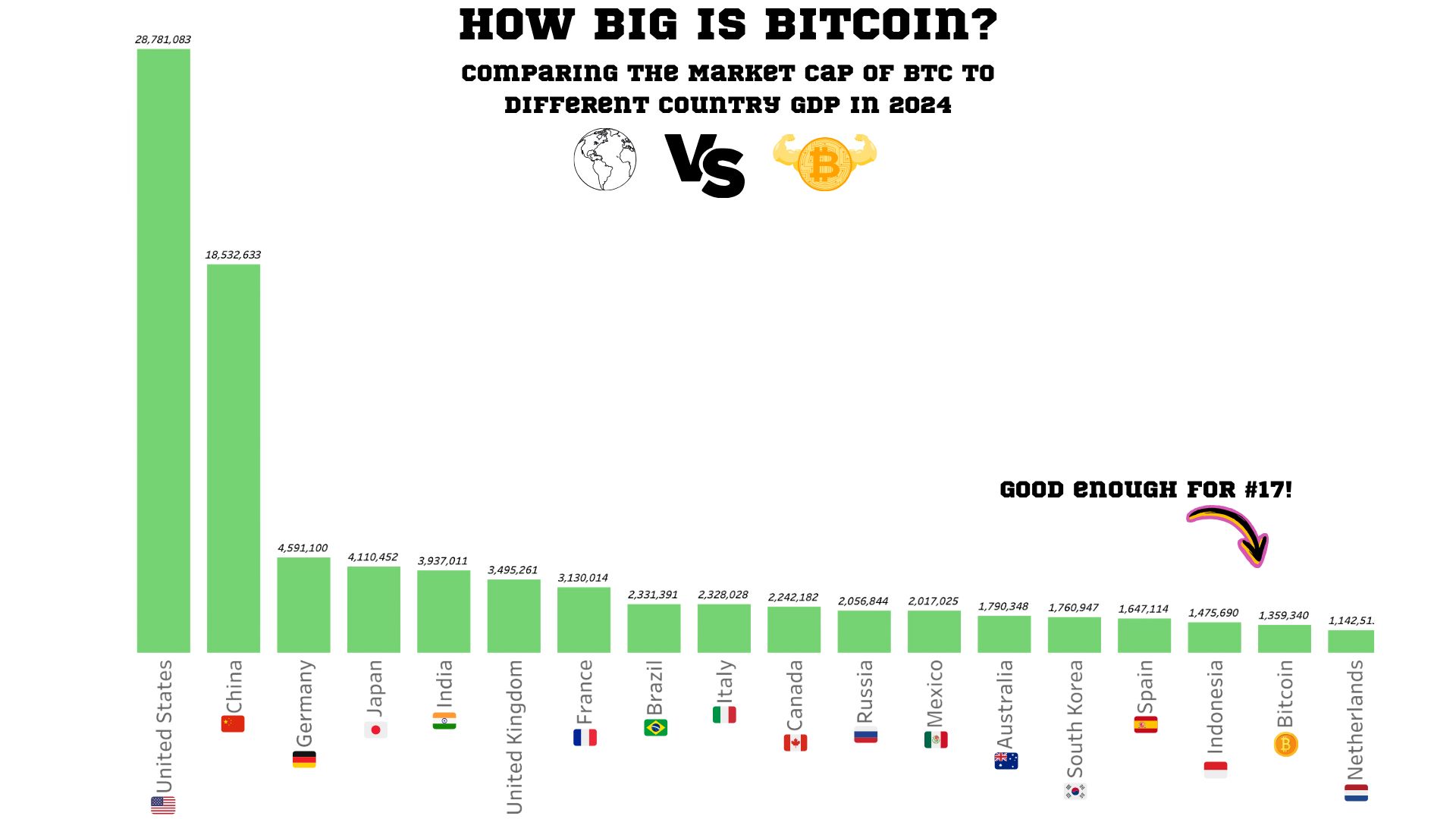

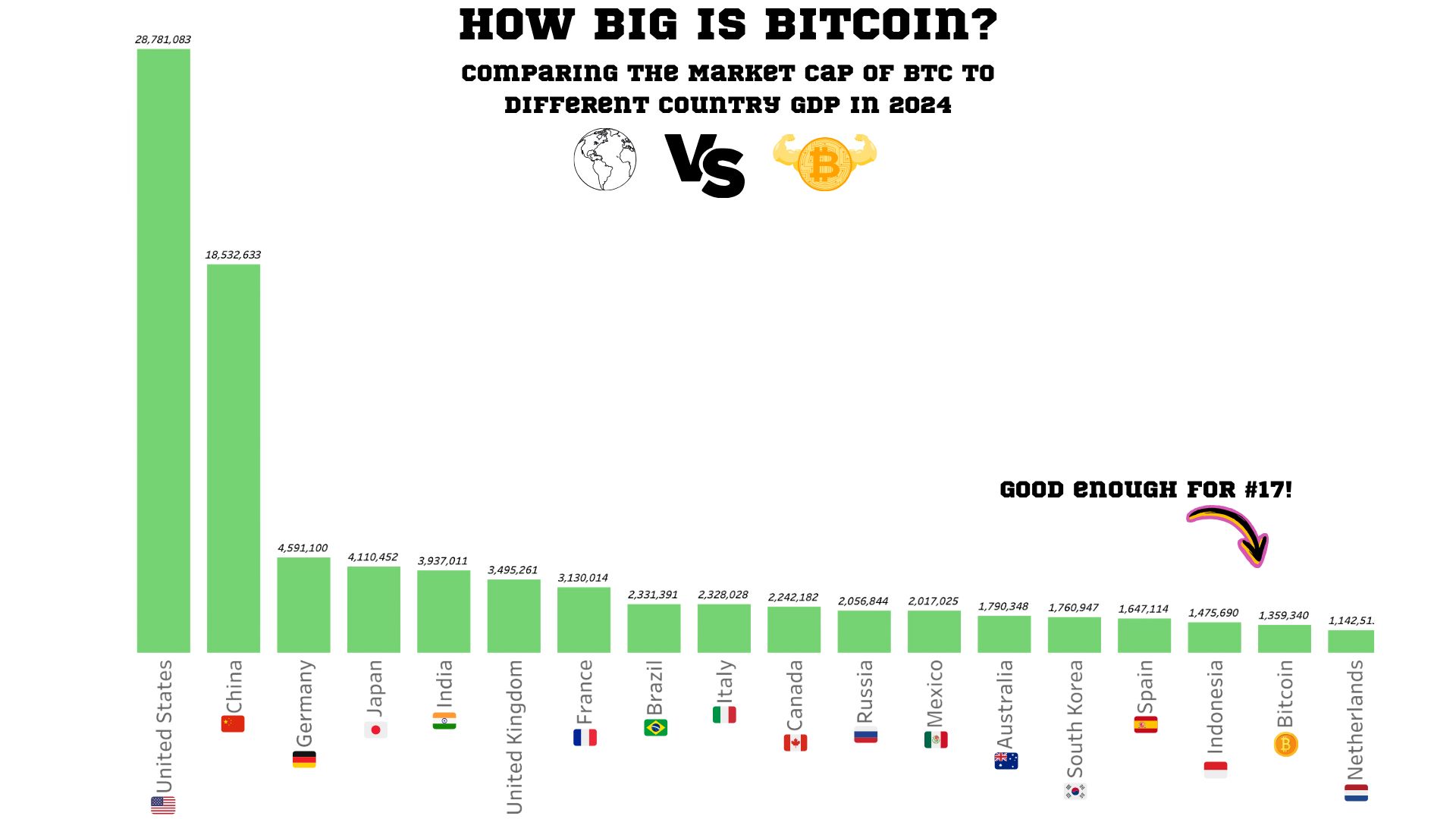

Throughout this article, we’ll investigate just how big BTC actually is – by comparing the market cap of BTC to the Gross Domestic Product (GDP) of various countries in 2024.

Is it actually possible that a virtual cryptocurrency could rival the economic output of sovereign nations?

Key Takeaways

- The rise of Bitcoin’s market cap, enough to rival the GDP of several countries by 2024, highlights the significant shift in global economics and the growing influence of digital finance.

- Market Capitalization refers to the total dollar value of a company’s outstanding shares of stock, while Gross Domestic Product encapsulates the total value of goods and services produced by a country in a particular time period.

- Comparing Bitcoin’s market cap to countries’ GDP provides a comparative study of digital versus traditional economic frameworks, exposing the evolving landscape of global economics.

- The growing impact of Bitcoin’s market cap on the global economy could influence economic policies, prompting more inclusive digital-oriented policies and a careful re-evaluation of existing regulations.

- Bitcoin’s market cap in 2024 is already high enough to rank #17, surpassing several nations’ GDPs like the Netherlands. This is a testament to the immense reach of the global economy, though it still trails behind major economies like the U.S. and China.

- The growing market cap of Bitcoin has significant implications for international trade and investment, potentially leading toward a decentralized economic framework.

- Regulatory issues, volatile market conditions, and security risks are major challenges presented by the rise of Bitcoin, however, it also open several opportunities for economic growth and technological advancements.

Understanding Market Capitalization and GDP

Here we will brush up on two key economic concepts, namely, Market Capitalization and Gross Domestic Product (GDP).

By understanding these concepts, we can better assess the actual size of cryptocurrencies like Bitcoin and their positioning in the global economy.

What is Market Capitalization?

Market Cap, short for Market Capitalization, refers to the total dollar value of all the company’s outstanding shares of stock.

It’s calculated by multiplying the company’s share price by the total number of its outstanding shares.

For instance, if a company has a million shares outstanding and the current share price is $10, the Market Cap would be $10 million.

It’s a straightforward way to gauge a company’s size and value, and it’s frequently used by investors to compare different companies on an equal footing.

What Is Gross Domestic Product (GDP)?

Shifting our focus to GDP, Gross Domestic Product encapsulates the total value of all the goods and services produced by a country in a particular time period.

Usually measured annually, GDP functions as a full scorecard of a country’s economic health.

For illustration, if a country reported a GDP of $5 trillion for a year, it means goods and services worth $5 trillion were produced within the country in that year.

GDP plays a critical role in shaping economic policies, determining the standard of living, and assessing economic performance across divergent nations.

This makes the exercise of comparing Bitcoin’s market cap with a nation’s GDP a “fair” exercise, showcasing the seismic shifts in the global economic world.

Why We’re Comparing BTC Market Cap to Country GDPs

As we journey further into the era of digital finance, understanding new economic paradigms becomes integral.

One such paradigm is the comparison of Bitcoin (BTC) market cap to countries’ Gross Domestic Product (GDP).

This comparison not only highlights shifts in the global economic arena but also prompts us to consider the potential ramifications of such changes on long-established economic structures.

Why Compare BTC to Country GDPs?

BTC and country GDPs present a comparative study of digital versus traditional economic frameworks.

Analyzing Bitcoin’s market cap delivers insight into the digital asset’s scale, measuring its total value based on the current number of bitcoins in circulation multiplied by the current Bitcoin price.

On the other hand, GDP exemplifies a tangible representation of a country’s economic health, quantifying the total value of goods and services produced over a specific time scale.

A side-by-side examination of these two metrics – one digital and the other traditional – helps us gauge the continually evolving economic world.

It’s an approach that highlights the digital currency’s tangible effect on the economy, challenging us to rethink conventional economic theories and norms – and to sound an alarm that cryptocurrency is here to stay.

Potential Impacts on Economic Policies

The penetration of Bitcoin into financial markets, given its comparison to country GDPs, implies a game-changing role in shaping economic policies worldwide.

For instance, a higher BTC market cap can substantiate constructive arguments for more inclusive digital-oriented policies, hence forging a bridge between traditional and digital finance.

It’s critical, though, to monitor and regulate these shifts judiciously, as consequences could be severe if overlooked.

Policymakers need to adapt to this paradigm change, formulating inclusive regulations that embrace the arrival of digital currencies, thereby harnessing their economic potential while mitigating associated risks.

Methodology for Comparison

Here, we discuss our data sources, their reliability, our calculation methods, and the assumptions underpinning our analyses.

Sources of Data and Reliability

The International Monetary Fund’s (IMF) 2024 forecasts are our primary data source. This globally recognized institution’s data is trustworthy, reinforced by 190 member countries, and aligns with the IMF’s mission to help global monetary cooperation, secure financial stability, and enhance economic growth.

By centering our comparison on this high-quality data, we aim to provide robust and revealing insights.

The Actual Numbers

| Country | GDP 2024 (in millions USD) |

| United States | 28,781,083 |

| China | 18,532,633 |

| Germany | 4,591,100 |

| Japan | 4,110,452 |

| India | 3,937,011 |

| United Kingdom | 3,495,261 |

| France | 3,130,014 |

| Brazil | 2,331,391 |

| Italy | 2,328,028 |

| Canada | 2,242,182 |

| Russia | 2,056,844 |

| Mexico | 2,017,025 |

| Australia | 1,790,348 |

| South Korea | 1,760,947 |

| Spain | 1,647,114 |

| Indonesia | 1,475,690 |

| Bitcoin | 1,359,340 |

| Netherlands | 1,142,513 |

| Turkey | 1,113,561 |

| Saudi Arabia | 1,106,015 |

| Switzerland | 938,458 |

| Ethereum | 453,170 |

Top Countries by GDP With Comparable BTC Market Caps

We’ve discovered that Bitcoin’s market cap, estimated at 1,359,340 Million USD (1.3T), surpasses several nations’ GDPs.

For instance, it’s higher than that of countries like the Netherlands, with a GDP of 1,142,513 million USD, and Turkey, at 1,113,561 million USD.

However, it falls below dominant global economies, such as the United States and China, which stand tall at 28,781,083 million USD and 18,532,633 million USD, respectively.

This signals Bitcoin’s impressive reach, though it still has some distance to cover in its race with the world’s largest economies.

Implications of BTC Market Cap in the Global Economy

With our newfound perspective around BTC’s market cap comparisons with various country GDPs, we study the potential ripple effects this development may have on critical aspects, such as international trade and investment and so economic growth.

Influence on International Trade and Investment

Shifting our focus to international trade, it’s apparent that BTC’s growing market cap has significant implications.

If Bitcoin’s market cap matches or even surpasses some countries’ GDPs, it changes how we think about trade and investment.

External forces traditionally shape these, such as international trade agreements and tariffs.

But, with Bitcoin emerging as a major player, we could be heading towards a decentralized economic framework.

For instance, the reduced transfer costs associated with Bitcoin transactions could revolutionize how business is conducted, potentially leading to an increase in cross-border trade.

Challenges and Opportunities for Economic Growth

While there are opportunities for economic growth with the rise of Bitcoin, it’s not without its challenges.

Regulatory issues, exposure to volatile market conditions, and the ever-changing sphere’s security risks are but a few examples of hurdles we must overcome.

On the flip side, if harnessed correctly, Bitcoin can offer unprecedented growth opportunities.

It can enable access to global markets, provide platforms for financial innovation, and contribute to technological advancements.

It’s undeniable that Bitcoin’s market cap directly confronting the GDPs of some countries signals the ushering in of a new economic order.

With change comes prospects for growth, and in Bitcoin, we may have a catalyst for that change.

Final Thoughts

Big and small countries alike feel the shift in global finance catalyzed by the advent of Bitcoin.

Notable among these impacts is the advent of borderless transactions.

Traditional avenues of international trade face a paradigm shift, where Bitcoin, with its decentralized nature, facilitates seamless international transactions.

Forecasts indicate that by 2030, this transformation could lead to minimized transaction costs, aiding businesses that rely heavily on inter-country trading.

But, this new economic order is not devoid of challenges.

Regulatory bodies struggle to keep pace with Bitcoin’s adaptability. Dealing with a decentralized currency that surpasses some nations’ GDPs brings along unique difficulties.

In the face of Bitcoin’s volatility and security risks, it’s indispensable to strike a balance that safeguards both investors and countries.

Yet, despite these hurdles, Bitcoin’s high market cap hints at promising growth opportunities.

As Bitcoin continues to penetrate more deeply into traditional finance, countries might be pressed to adapt or risk lagging in the global race.

Hence, Bitcoin signifies an epoch of transformation and prospects, daunting yet laden with unrivaled potential.

Never miss an Update!

Never miss an Update!  Top Cryptos to buy?

Top Cryptos to buy?