In its own DeFi-spin on Forbes' rich list, London-based investment migration consultancy Henley & Partners has published the ‘Crypto Wealth Report 2023’.

As its name suggests, the study reported on statistics concerning the crypto space’s biggest whales. To do so, it made use of the ‘Henley & Partners Adoption Index’ as a tool for keeping tabs on the largest holdings. It also drew on public data shared by the likes of CoinMarketCap, Etherscan, and Binance, as well leveraged the company’s in-house tier models which graphically benchmark different ‘levels’ of high net worths.

As you’ll later read, the report also focused on statistics that reference the entire geopolitical crypto landscape.

The inaugural Crypto Wealth Report published by Henley & Partners indicates that the total market value of crypto is now a staggering USD 1,180 billion and there are 425 million individuals globally that own cryptocurrencies.https://t.co/8tG4Ay6loH#CryptoWealthReport #Crypto

— Henley & Partners (@HenleyPartners) September 5, 2023

The Individual Crypto Whales

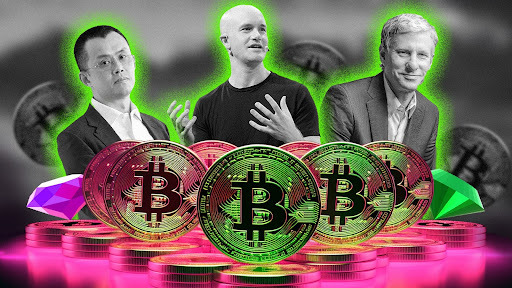

The ‘Crypto Wealth Report 2023’ states that a total of 6 Bitcoin billionaires live in and among us, as well as 22 billionaires who have holdings across multiple crypto and altcoins.

Within the latter category, obvious figures such as Binance CEO Changpeng Zhao (CZ), Coinbase CEO Brian Armstrong, and Ripple co-founder Chris Larsen were mentioned.

The report also announced that there are 88,200 crypto millionaires, with almost half of these portfolios holding over $1 million worth of Bitcoin.

Of these 88,200, 78 individuals are Bitcoin centi-millionaires, whilst 182 hold $100 million or more across multiple cryptocurrencies.

Intuitively, this statistical skew in favour of Bitcoin holders arises through the fact that many investors would’ve purchased hundreds - if not thousands - of BTC throughout the year or so when the asset cost less than a cheeseburger.

Crypto Bulls and Whales By Country

Although geared towards the upper echelons of crypto holders, the report also took note of global crypto adoption levels.

In conclusion, it included a whole host of positive milestones and achievements regarding success and relative longevity of the space thus far. This led to it describing DeFi as the “pinnacle of trade and technology over the past three decades,” whilst likening its success and trajectory to the ‘dot com bubble’ of the late 1990s and early 2000s.

Other key takeaways came from the report’s country-by-country comparisons.

For example, it ranked countries in order of number of crypto whales- with the US leading the way with the majority, followed by India, China, Brazil, and Russia.

Here, the likes of Montenegro and Portugal were also reported as crypto hotspots, whilst Switzerland topped the ranks in terms of being the biggest by-country crypto investor- followed by the UAE, the US and UK, Australia, Canada, Malta, and Malaysia.

When it comes to the US specifically, the country was able to dominate across several crypto metrics despite its visible regulation frailties- including in infrastructure adoption and integrations at local banks and ATMs.

For its cousins across the pond, the UK fared best in terms of tech and innovation, with Singapore and the UAE also getting a nod for their crypto-friendly tax policies.

Want More Cutting-Edge Crypto News?

Follow Us: X TikTok Instagram Telegram LinkedIn

Sign up to our newsletter at the bottom of the page

Check Out Our Top 10 Crypto Currencies of 2023

This article is intended for educational purposes and is not financial advice.