It's already been two weeks since the criminal trial of disgraced crypto figure and FTX CEO Sam Bankman-Fried (SBF) commenced, and as we’ve been reporting, the majority of such timeframe has seen prosecutors talk to key witnesses from the case such as Caroline Ellison and Gary Wang.

As we all know by now, the ultimate goal of such efforts is to prove to jurors that SBF had intended to defraud customers, investors, and lenders amid the almighty collapse of his FTX crypto exchange.

In this article we’ll run you through each and every poignant development from inside the high-stakes New York courtroom thus far.

The SBF Trail - Week 1

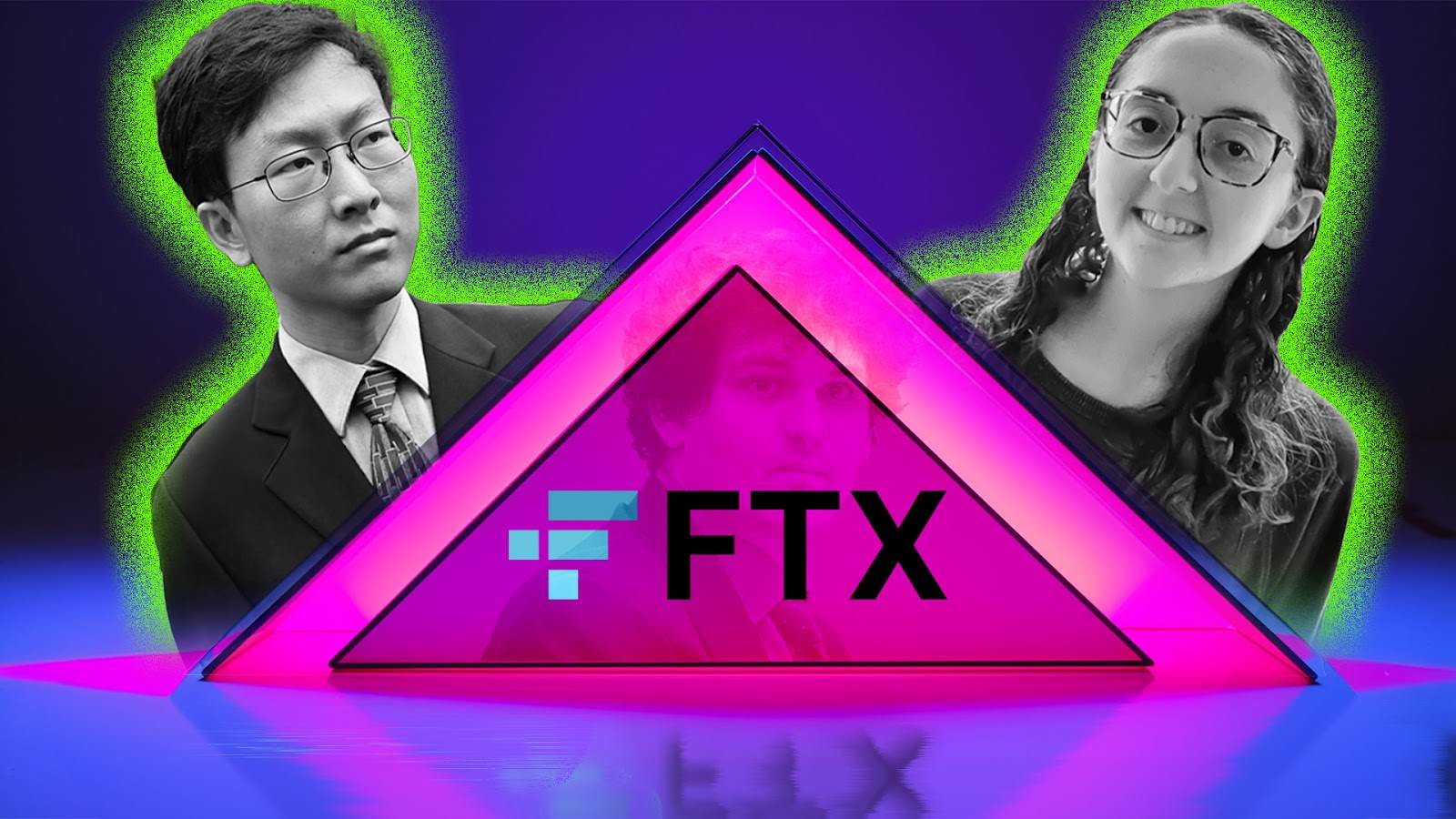

The first week of the trial conjured up several notable talking points, with one of the most-documented being the testimony of SBF’s fellow FTX co-founder Gary Wang. Here, Wang testified that SBF directed all FTX-related crimes, however he also admitted having involvement in wire, securities, and commodities fraud himself.

Adam Yedidia, another former FTX developer, was also able to shed more light into the case through revealing that he resigned in November 2022 after discovering a ‘customer defraud’ scheme (something that was later removed from all records).

Further, through Yedidia’s testimony it became evident that the problems revolving around tracking customer debts had arisen through FTX customers depositing funds into Alameda through wire transfers. Through this relatively unique and complex method for managing customer funds, Alameda’s holdings were inflated by $8 billion.

Two other entities also came for SBF, with the first being Matt Huang, who is the co-founder of tech investment firm Paradigm. Here, Huang testified that his company invested around $278 million in various FTX funding rounds, however as of today, such equity is worth $0.

And then came the US Department of Justice, which issued a forfeiture bill for seizing SBF-owned assets (which are reported to include two aircrafts; a Bombardier Global and an Embraer Legacy).

On a side note, the inaugural week of the trial also reportedly saw one jury member fall asleep whilst on duty.

A Spotlight on Caroline Ellison - Week 2

Undoubtedly, the testimony of former Alameda CEO and ex-girlfriend of SBF Caroline Ellison was the headline act of the trial's second week.

A breakdown of such a topic - which involves 10+ hours of revealing SBF’s deceit galore, control freakiness, bribery, and even identity fraud using Thai prostitutes - can be found here.

Another Ellison revealing from later on in the week was that her ex-boyfriend was also in talks with Saudi Prince Mohammed Bin Salman over the potential of being offered financial support to cover losses before FTX’s eventual bankruptcy declaration.

When it comes to her own Alameda Research (in which SBF still ruled the reigns over in practice), she also disclosed that accountants in 2021 and 2022 declined to run an audit on the company over concerns that were found when examining its financial records.

Similar to Huang at Paradigm, BlockFi CEO Zac Prince also took to the stands to blame his company’s bankruptcy on the fraudulence of SBF and FTX.

Ellison’s Poor Executive Performance

And in addition to the criminal charges she’s pleaded guilty to, Ellison also admitted to underperforming as Alameda Research CEO… a role which essentially saw her handle most of the investment firm’s operations whilst SBF focused on the more nascent FTX.

Such news arose via excerpts read from her personal notes, which revealed her desire to resign from the role in the weeks and months preceding FTX’s fall (i.e. around the same time in which co-CEO Sam Trabucco resigned).

Further, complications arose way before November 2022, as herself and SBF parted ways in April of last year, which then led to Ellison purposely avoiding meetings with him (despite the fact that they still lived in the same luxury apartment in the Bahamas).

Ellison then revealed that despite her poor performance, SBF wanted her to continue in the role as her departure could’ve sparked discussions regarding the financial health of the company.

What’s Next

Now two weeks in, the prosecution aims to conclude its case by the middle of next week (October 26-27), which will then be followed by the response of SBF’s defence team.

And when it comes to Ellison, she will soon have her sentence read for the seven counts of fraud and conspiracy to commit fraud that she was charged with. Given her cooperation with the US department of justice since December 2022, the sentence that she receives is promised to be one of reduced capacity.

Want More Cutting-Edge Crypto News?

Follow Us: X TikTok Instagram Telegram LinkedIn

Sign up to our newsletter at the bottom of the page

Check Out Our Top 10 Crypto Currencies of 2023

This article is intended for educational purposes and is not financial advice.