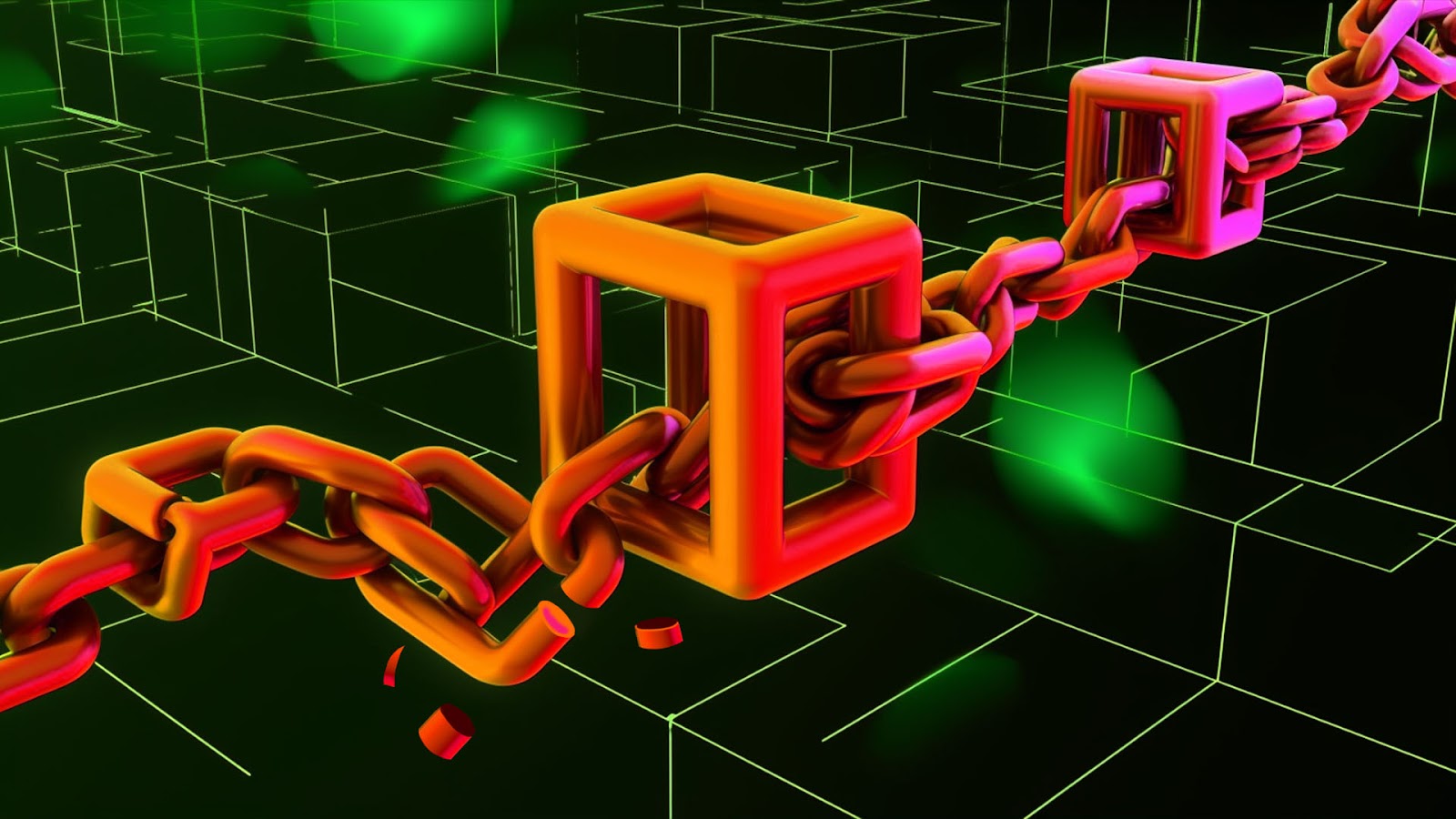

Blockchain Congestion refers to when a blockchain network such as Bitcoin experiences an overload of transactions, leading to delays, increased fees and in some cases a backlog of unprocessed transactions.

Blockchain congestion affects the functionality and efficiency of a blockchain.

What is Blockchain Congestion

Blockchain congestion or network congestion occurs when there are many transactions all sent at the same time, exceeding the network capacity. Every blockchain has a maximum number of transactions per second that it can handle, also called TPS.

Blockchain congestion results in slow transaction processing times and high transaction fees, making it expensive to complete transactions on the blockchain.

Different consensus mechanisms such as Proof-of-Work or Proof-of-Stake help to add blocks to the blockchain.

Each block has a limited capacity to accommodate transactions, when a number of transactions surpasses the network's capacity, congestion sets in.

Despite the limitations of certain blockchain technologies, layer 2 scaling solutions exist to scale a blockchain to help accommodate a higher volume of transactions.

Causes of Blockchain Congestion

The primary cause of blockchain congestion is a surge in transaction volume.

As more users engage with a blockchain network, the demand for transaction processing increases.

Networks that are designed for low transaction volumes may need help to cope with sudden spikes, leading to congestion.

Bitcoin, for example, is a blockchain network that has scalability challenges.

The PoW consensus mechanism Bitcoin uses has limited throughput, which is the measure of how many units of information a system can process at any given amount of time.

Bitcoin uses the lightning network to ease the pressure on the main blockchain, as a scalability solution. Transaction fees are also drastically reduced which helps Bitcoin to function in a wider range of use cases.

Ethereum is another blockchain that also experiences blockchain congestion.

During times of increased volumes of transactions, the Ethereum blockchain experiences huge spikes in transaction fees.

Ethereum has an optimistic rollup called Arbitrum that is designed to improve user cost and transaction speed by moving computation and data storage off-chain. These solutions provide scalability without compromising security.

Final Thoughts

Layer 2 solutions like the lightning network help reduce blockchain congestion.

Bitcoin needs these applications to reduce the load on the primary blockchain, providing a scalable way to process more transactions.

As blockchain networks increase collaboration and the adoption of interoperability standards increases, blockchain networks can facilitate seamless transactions across a range of networks, reducing the risk of congestion.

By understanding the causes, implications and potential solutions to address blockchain congestion, a more robust and efficient blockchain ecosystem will emerge.

FAQ

What Causes Blockchain Congestion?

Several factors, including increased transaction volume, limited scalability of the blockchain and network resource constraints cause blockchain congestion. As more users join a blockchain, this can lead to increased congestion.

How Can You Address Blockchain Congestion?

You can address blockchain congestion through layer 2 scaling solutions like the lightning network and optimistic rollups, they help to ease congestion from the main blockchain, offering faster and more cost-effective transactions.

How Many Blockchains Have Blockchain Congestion?

Most blockchains experience blockchain congestion, including the most popular cryptocurrencies, Bitcoin and Ethereum, blockchains cannot do everything, they need help to expand their capabilities.

Want More Cutting-Edge Crypto News?

Follow Us: X TikTok Instagram Telegram LinkedIn

Sign up to our newsletter at the bottom of the page

Check Out Our Top 10 Crypto Currencies of 2023

This article is intended for educational purposes and is not financial advice.